Your Health Magazine

4201 Northview Drive

Suite #102

Bowie, MD 20716

301-805-6805

More Medical Billing Articles

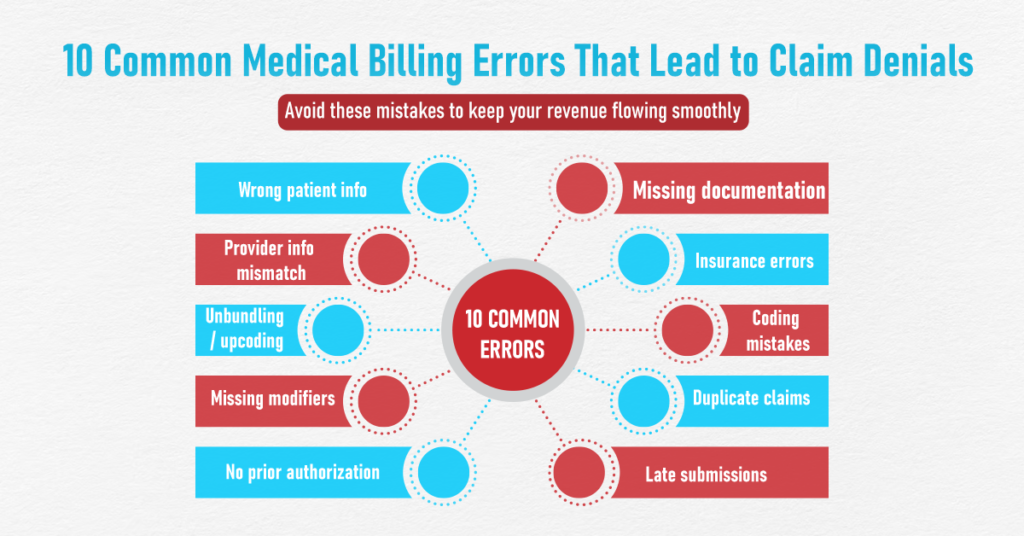

10 Common Medical Billing Errors That Lead to Claim Denials

Claim denials remain one of the most persistent challenges in healthcare revenue management. They disrupt cash flow, increase administrative workload, and often delay or reduce reimbursement for services already delivered. While payer rules and policies continue to evolve, many denials still stem from preventable billing and documentation errors.

Understanding where these mistakes occur is the first step toward improving claim acceptance rates and maintaining financial stability.

1. Incorrect Patient Demographics

Errors in patient information such as misspelled names, incorrect insurance ID numbers, or inaccurate dates of birth are among the most common reasons claims are rejected. These issues typically originate during patient registration and can prevent claims from being processed at all.

Routine verification of patient details at every visit helps eliminate this problem before it reaches the billing stage.

2. Failure to Verify Insurance Eligibility

Submitting claims without confirming active insurance coverage frequently results in denials. Coverage may change between visits, lapse entirely, or exclude specific services.

Eligibility verification before care is provided allows practices to identify coverage limitations, required referrals, and patient financial responsibility in advance.

3. Diagnosis and Procedure Code Mismatches

Coding errors involving ICD-10 diagnosis codes and CPT or HCPCS procedure codes are a major contributor to claim denials. Payers often deny claims when the diagnosis does not adequately support the billed service.

Accurate coding depends on up-to-date knowledge, detailed clinical documentation, and consistent alignment with payer policies.

4. Incomplete or Insufficient Documentation

Even when services are medically necessary, inadequate documentation can result in denied claims. Missing provider signatures, vague progress notes, or lack of justification for services rendered all raise red flags for insurers.

Documentation should clearly reflect the patient’s condition, services provided, and clinical decision-making.

5. Incorrect Use of Modifiers

Modifiers play an essential role in explaining how or why a service was performed. Incorrect or missing modifiers can cause claims to be denied or reimbursed at a lower rate than expected.

Because modifier rules vary by payer, staff must stay informed about payer-specific requirements to ensure accurate reporting.

6. Missed Timely Filing Deadlines

Each payer enforces strict timelines for claim submission. Claims submitted after these deadlines are typically denied without the option for appeal.

To avoid this issue, many practices rely on structured claim-tracking systems or collaborate with a medical billing company to ensure submissions and follow-ups occur within required timeframes.

7. Duplicate Claim Submissions

Duplicate claims are commonly denied and may trigger additional payer scrutiny. These errors often occur when payment delays cause uncertainty about claim status.

Clear tracking of submitted, pending, and paid claims helps prevent unnecessary resubmissions.

8. Upcoding and Undercoding

Upcoding billing for a higher level of service than documented can result in denials, audits, or compliance penalties. Undercoding, while less risky, leads to lost revenue.

Both issues often stem from unclear documentation or misunderstanding of coding guidelines and should be addressed through proper training and internal audits.

9. Missing Prior Authorizations

Many procedures, diagnostic tests, and specialty services require prior authorization. Failure to obtain authorization before services are rendered almost always results in claim denial, regardless of medical necessity.

Authorization requirements should be verified well in advance, particularly for imaging, behavioral health, and specialty care services.

10. Weak Denial Management Processes

Not all claim denials are final. Many can be corrected and appealed successfully when addressed promptly. However, lack of follow-up, missed appeal deadlines, or incomplete appeal documentation can result in permanent revenue loss.

This is where experienced medical billing providers focus on denial trend analysis, timely appeals, and corrective actions to prevent repeat errors.

Why Billing Accuracy Matters More Than Ever

Healthcare billing continues to grow more complex due to regulatory changes, payer policy updates, and evolving documentation standards. Even small errors can have a significant financial impact when multiplied across hundreds or thousands of claims.

Practices that prioritize accuracy, compliance, and proactive denial prevention are better positioned to maintain consistent cash flow and operational efficiency.

Conclusion

Most claim denials are avoidable. From inaccurate patient data to coding errors and missed authorization requirements, these mistakes often result from process gaps rather than payer decisions.

By strengthening documentation practices, verifying insurance details, monitoring claim timelines, and addressing denials systematically, healthcare organizations can significantly reduce revenue leakage. A proactive approach to billing accuracy not only protects reimbursement but also supports long-term financial sustainability in today’s complex healthcare environment.

Frequently Asked Questions (FAQs)

1. What is the most common reason for medical claim denials?

The most common reasons include inaccurate patient information, coding errors, missing documentation, and failure to verify insurance eligibility. These issues often occur early in the billing process and can usually be prevented with proper verification and documentation practices.

2. How do coding errors affect claim reimbursement?

Coding errors can cause claims to be denied, delayed, or reimbursed at a lower rate. When diagnosis codes do not support the billed procedures, insurers may reject the claim due to lack of medical necessity or policy non-compliance.

3. Can denied claims be corrected and resubmitted?

Yes, many denied claims can be corrected and resubmitted if addressed within the payer’s appeal timeframe. Successful resubmission depends on identifying the root cause of the denial and providing complete, accurate supporting documentation.

4. Why is prior authorization important in medical billing?

Prior authorization confirms that a service is approved by the insurance payer before it is performed. Without authorization, claims are often denied even if the service was medically necessary, particularly for specialty procedures and diagnostic services.

5. How can healthcare practices reduce claim denial rates?

Practices can reduce denials by verifying patient eligibility, maintaining accurate clinical documentation, using correct codes and modifiers, monitoring timely filing deadlines, and implementing structured denial management processes.

Other Articles You May Find of Interest...

- Why Medical Billing Errors Are One of the Biggest Hidden Threats to Patient Care

- Revenue Cycle Management in Medical Billing: From Patient Registration to Payment Posting

- How Medical Billing Errors Impact Patient Care and What Providers Can Do About It

- 10 Common Medical Billing Errors That Lead to Claim Denials

- The Difference Between Treating Symptoms and Supporting People

- A Practical Guide to CPT & ICD Coding for Psychiatry in 2025–2026

- Best Medical Billing Services for Small Practices